New Report Explores How Sustainable Finance Can Bridge the Road Safety Funding Gap

February 26, 2025

GRSF and the World Bank Treasury have published a groundbreaking new report, Financing Road Safety: Catalyzing the Sustainable Finance Market to Bridge the Gap. The report provides practical guidance to governments on how to access innovative financial instruments to mobilize private capital for essential road safety projects.

Road traffic injuries claim approximately 1.19 million lives annually, with low and middle-income countries disproportionately bearing 92% of these fatalities despite possessing only 60% of the world's vehicles. The economic impact is profound, costing these nations about $1.7 trillion each year, equivalent to 2%–6% of their GDP. Traditional funding and financing mechanisms have proven inadequate to address this crisis.

In fact, a recent study estimated that the funding gap to achieve the UN Sustainable Development Goal of halving road crash fatalities and serious injuries by 2030 is approximately $400 billion, which is the estimated amount needed to pay for road upgrades, enforcement campaigns, vehicle safety improvements, and other interventions that, taken together, can reach this target.

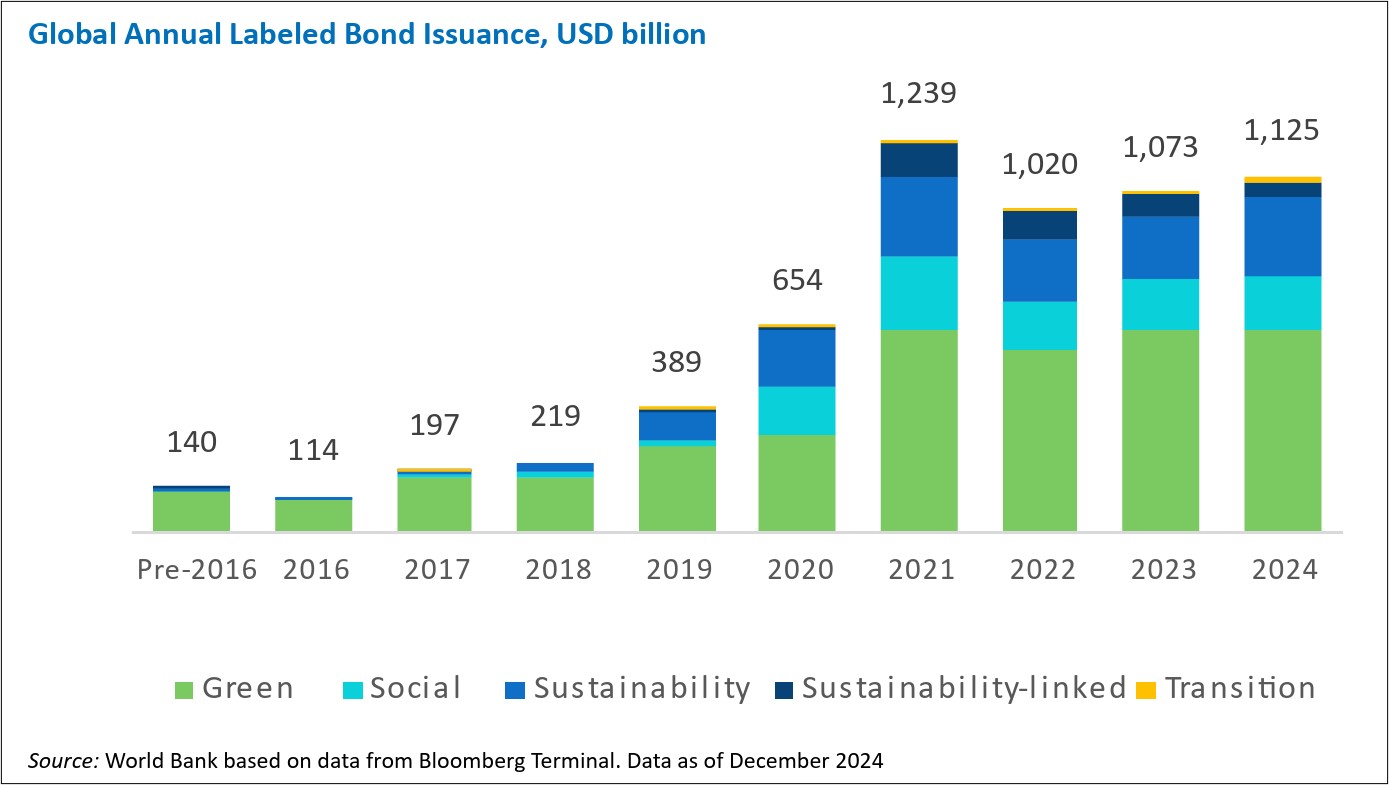

The new report highlights the potential of “labeled” sustainable finance instruments—such as green, social, sustainability, and sustainability-linked bonds and loans—to help close the funding gap. By linking road safety initiatives with investors' environmental, social, and governance (ESG) priorities, these financial instruments can unlock private capital for critical road safety programs. The report serves as a practical guide for governments, multilateral development banks (MDBs), and the private sector, outlining how these instruments can be effectively structured and deployed to maximize impact.

Sustainable bond issuances have exceeded $1 trillion annually for four consecutive years, reflecting strong global demand for ESG-aligned investment projects. The guide maps out eligible road safety investments and aligns them with recognized green and social bond categories under international Capital and Loan Market principles. By tapping into these instruments, national and subnational governments, as well as state-owned enterprises, can secure financing for large-scale road safety programs that would otherwise remain underfunded.

Despite progress, road crashes remain a major public health crisis, and scaling up financing is crucial to save more lives. Expanding investment in road safety projects—including through sustainable bonds, blended finance, and other mechanisms to leverage private capital—is one way we can meet this urgent and growing need.

Guangzhe Chen

World Bank Vice President for Infrastructure